reit dividend tax malaysia

Ad Get Direct Access To Private Real Estate Through Our Superior Reit-based Portfolios. Axis REIT Managers Berhad Penthouse Menara Axis No.

Association Seeks Tax Free Dividends For Reits The Edge Markets

AI-Aqar Healthcare REIT.

. The government currently imposes a 10 withholding tax on REIT dividends to local and non-resident individual investors. Investors usually consist of Malaysians foreigners. If a Real Estate Investment Trusts fund distributed at least 90 percent of their total yearly income to unit holders the REIT itself is exempted from tax for that year of assessment.

REAL ESTATE INVESTMENT TRUST. There is no capital gains tax regime in Malaysia for the sale of. The government currently imposes a 10 withholding tax on REIT dividends to local and non-resident individual investors.

Interactive Brokers clients from 200 countries and territories invest globally. If this 90 condition is not met the REIT would be subject to tax at the prevailing corporate income tax rate of 24. AMFIRST REAL ESTATE INVESTMENT TRUST.

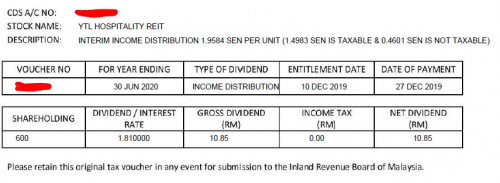

603 2034 7000 Fax. Ad We Offer Over 70 Funds With 4 5 Star Ratings From Morningstar. Taxation of dividend income distributed by REIT in the hand of investors.

Another thing that you need to know about TradePlus MSCI Asia ex-Japan REITs Tracker. An Edward Jones Financial Advisor Can Partner Through Lifes Moments. ETF 2 MyETF MSCI Malaysia.

2 more Malaysia-listed ETFs that pay decent dividends. REITs tend to pay out steady incomes similar to dividends which are derived from existing rents paid by tenants who occupy the REITs properties. Withholding tax of 10 or 25.

Ad Invest globally in stocks options futures currencies bonds funds from one screen. Visit The Official Edward Jones Site. As mentioned earlier a REIT company in Malaysia has to distribute at least 90 of its yearly income to enjoy tax exemption.

KUALA LUMPUR Sept 13. 2 Jalan 51A223 46100 Petaling Jaya Selangor Darul Ehsan Malaysia. New Look At Your Financial Strategy.

Taxation and tax exemption of REITs in Malaysia. REITPTF level-subject to tax 2000-not subject to tax REITPTF 10000 -not subject to tax REITPTF 14000 Distribution from REITPTF Distribution from REITPTF Year 2 RM Year 1 RM. REITs by the Capital Markets and.

Now You Can Use Fundrise Reits To Diversify The Way Successful Institutions Do. A REIT needs to pay tax on any taxable income earned during the year at a rate of 24 unless it distributes at least 90 of its total income to the unit holders during the year. Invest in Morningstar 4 and 5 Star Rated Funds.

Simply put the rental. High Dividend Yield. REIT dividends received after 31 Dec 2011 will be taxed at original 20 for foreign institutional investors and 15 for non-corporate investors including resident and non-resident inviduals.

Otherwise the total income of. As interest rates continue to be low the real estate investment trusts REITs dividend yields of 5 to 9 from 2022 onwards are attractive and. REIT ª REIT BURSA MALAYSIA BHD 15th Floor Exchange Square Bukit Kewangan 50200 Kuala Lumpur Malaysia Tel.

Listed REITs in Malaysia are exempted from annual. 19 rows Name Fullname Code Price PE ROE Payout ratio Gearing Ratio TTM DY Yield Link. If 90 or more of its total income is distributed to unit holders a real estate investment trust in Malaysia will be exempt from income tax.

Performance Analysis For Malaysia Reits Aug 2005 Dec 2010 And Islamic Download Table

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide

Reits Real Estate Investment Trusts And Tax Withholding Tax Worldwide

5 Criteria I Use To Pick Outstanding Reit Marcus Keong

How Are Individual Reit Holders Taxed

Finance Malaysia Blogspot Understanding Reits

How To Invest In Malaysia Reits Best Guide For Beginner Ringgit Insider

Multi Management Future Solutions Malaysia Tax On Reit Investment Malaysia Starting For The Year 2009 Tax For Reit Dividend Is As Follows Also Grab The Opportunity Of Free Analysis Report

Pdf Benchmark For Reit Performance In Malaysia Using Hedonic Regression Model Semantic Scholar

Axis Reit Archives Dividend Magic

Summary Of Reits Stock Quote And Listed On Main Board Of Bursa Malaysia Download Table

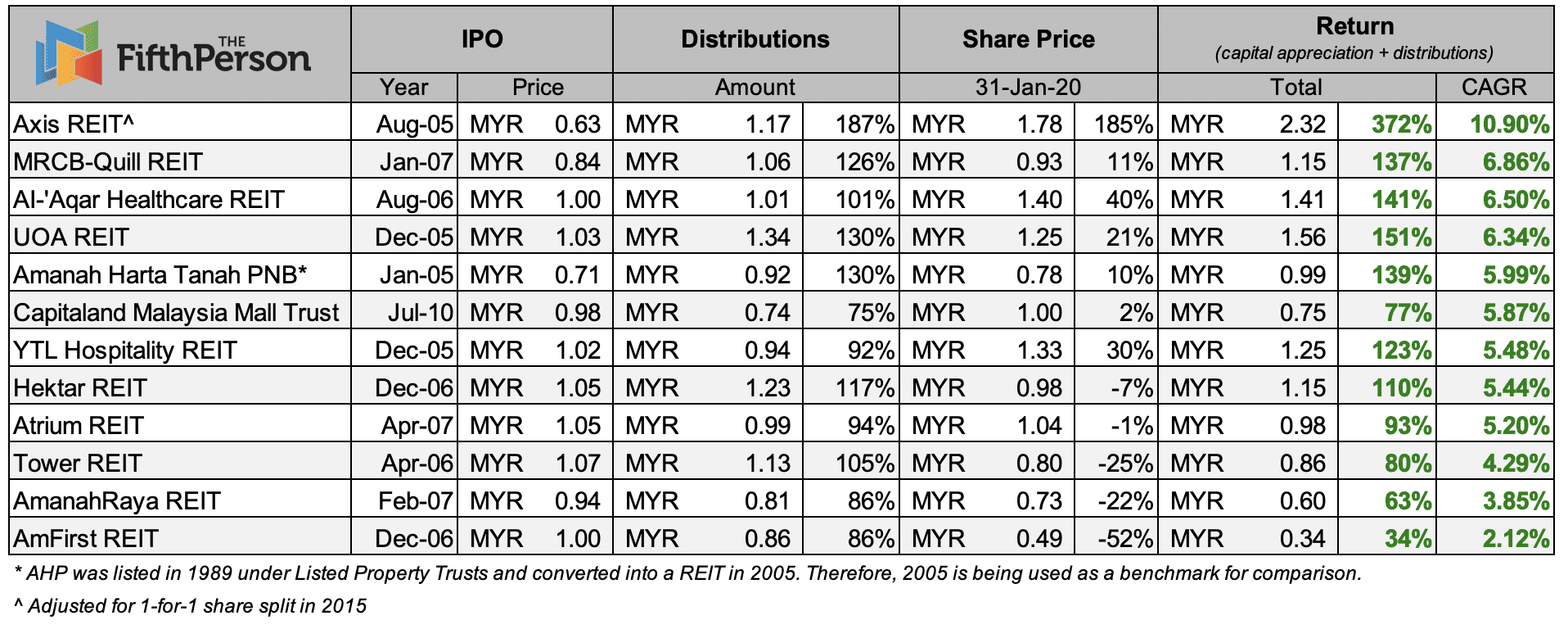

Top 5 Malaysian Reits That Made Money If You Invested From Their Ipos

Reits As A Less Stressful Option Pressreader

India Implications Of The Finance Bill 2020 On Invits Reits And Its Unitholders Conventus Law

How To Invest In Malaysia Reits Best Guide For Beginner Ringgit Insider

Dividend Withholding Tax Rates By Country For 2021 Topforeignstocks Com